IRS Trouble Solvers Successfully Negotiated Reduced Tax Obligation for DuPage County Medical Practice

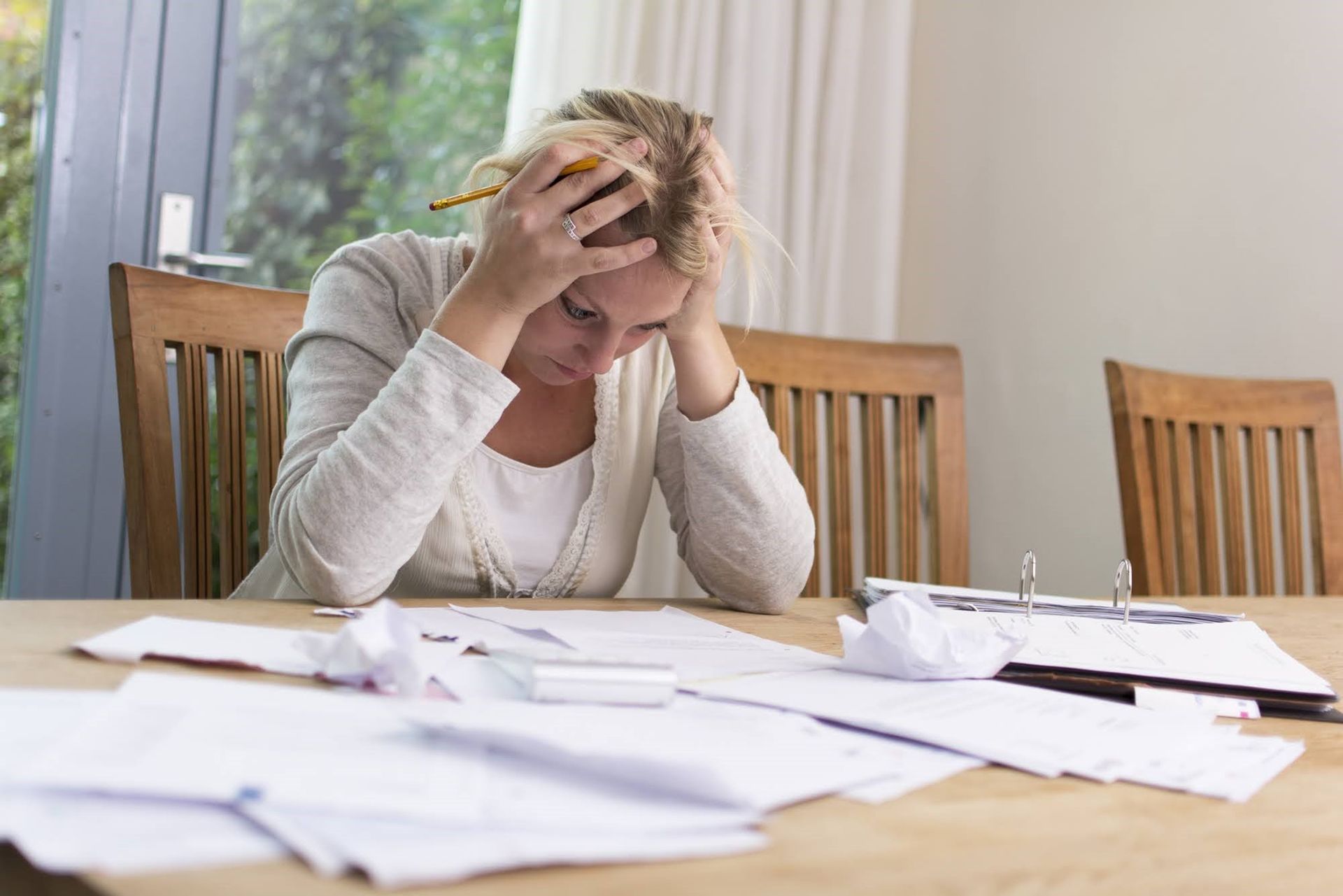

As the owners of a high volume medical practice, my wife and I came under great distress when the business was hit unexpectedly with an audit after an accounting blunder drew the scrutiny of the IRS. Things took a turn for the worst when the audit identified considerable discrepancies in the amount of income filed for the prior two years. An overwhelming situation for us to say the least, we turned to Patrick T. Sheehan & Associates for guidance — a move that turned out to be the best I believe we could have made.

Deployed to lead in our battle against the IRS — the firm’s Greg Dzialo could not have done a better job turning what we anticipated to be a nightmare into a process that was totally manageable and surprisingly painless. And even more recommendable than Greg’s efficiency and professionalism was the sincerity and devotion with which he represented our case. We felt truly confident that Greg took our case to heart and was determined to win the best outcome possible for us. And in the end, I believe he did just that: that outcome being a very feasible payment plan that won’t stand in the way of our practice continuing in a positive direction.