Do I Need Audit Representation?

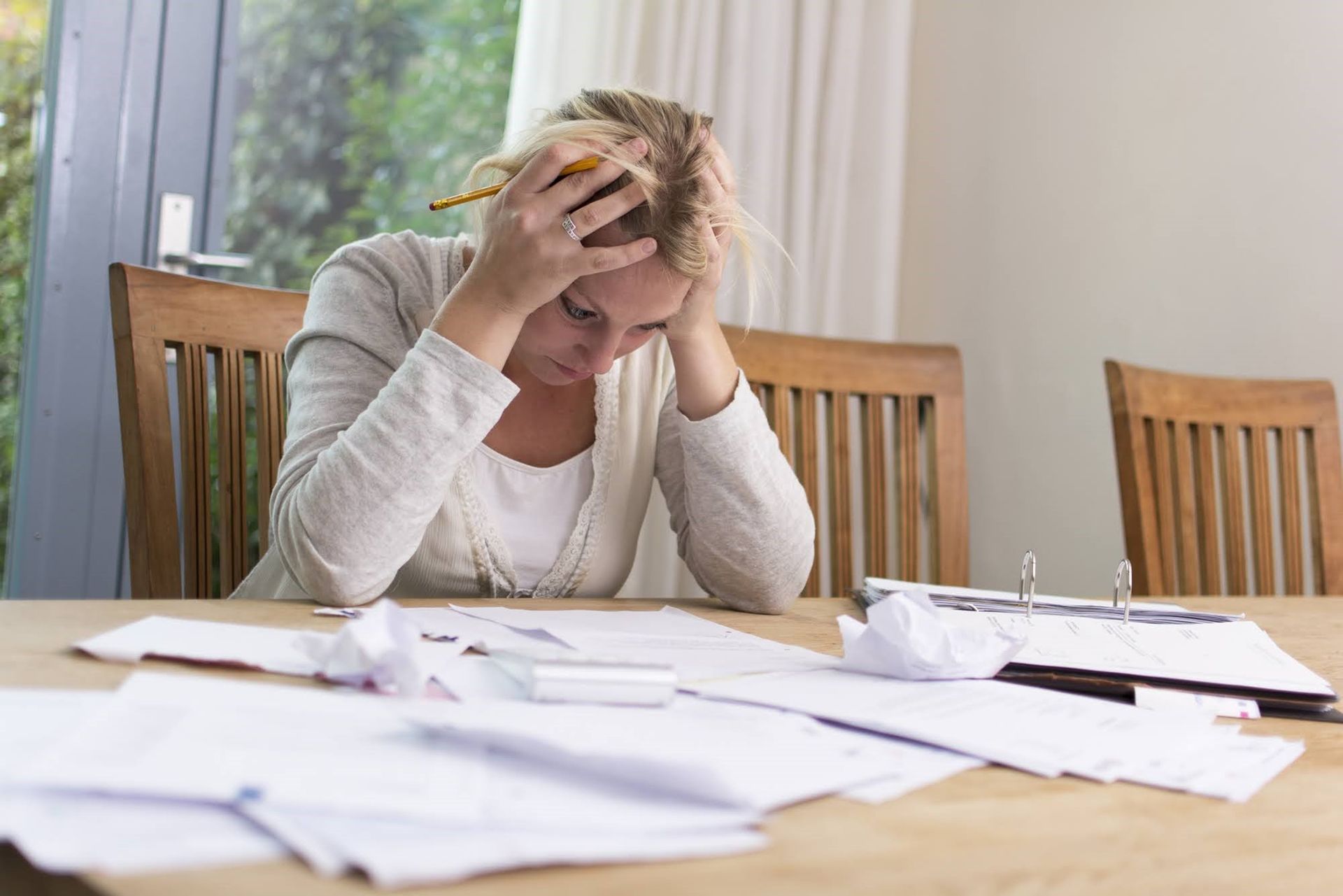

Tax audits are intimidating and stressful. You meet with an IRS agent and need to be prepared to defend yourself. Stress levels will be higher for those who have triggered tax audits for reasons like not reporting all of your income, deducting too many business expenses, claiming too many losses, or too many charitable donations. Some reasons may be easier to explain, such as innocent math errors or accidentally using the wrong filing status. And while you may have the supporting documentation to prove your claimed deductions, losses, and expenses, new questions may always arise.

Reasons Why You May Want a Tax Professional for Audit Representation

Lack of knowledge in tax code - While not all tax audits are serious, a deficiency of tax code and regulation knowledge may lead you to not properly defend yourself. A tax professional can review your account to determine how to strategize your defense.

Lack of time - As a taxpayer, you have the right to be represented by a tax professional, allowing you not to be present for the audit interview. This option benefits the taxpayer who is too busy to attend an audit interview or would prefer that someone knowledgeable in tax law speaks on their behalf.

Bear in mind; you will need to be present if you’ve been issued an administrative summons. If there were ever a situation in which it is highly recommended for you to have a tax professional by your side, this would be it. During an administrative summon, you will need to produce financial records and other data for the IRS representative to examine. You may have to provide testimony under oath. Working with a tax professional means being fully prepared with the right documents and defense.

Privacy issues – For various personal reasons, you may not want the IRS representative to visit your home or office, which happens if you’ve been assigned a field audit. With representation, the field audit can be rescheduled, and the IRS agent can meet your tax representative at their place of business. And while the auditor may still need to tour your business, having audit representation means having someone on your side ensuring your rights as a taxpayer are being met.

So, while you feel you may not need a tax lawyer for audit representation, you most likely need a tax professional to prepare. The reason why you were audited in the first place may have been due to a lack of knowledge in accurately preparing your tax return. This is not uncommon as most taxpayers do not understand the complexities of tax codes as a tax expert would.

Contact us at 630-832-6500 to set up your complimentary consultation. We’re here to help individuals and business owners with their tax concerns and troubles.